Compliance - SOX Compliance Solution

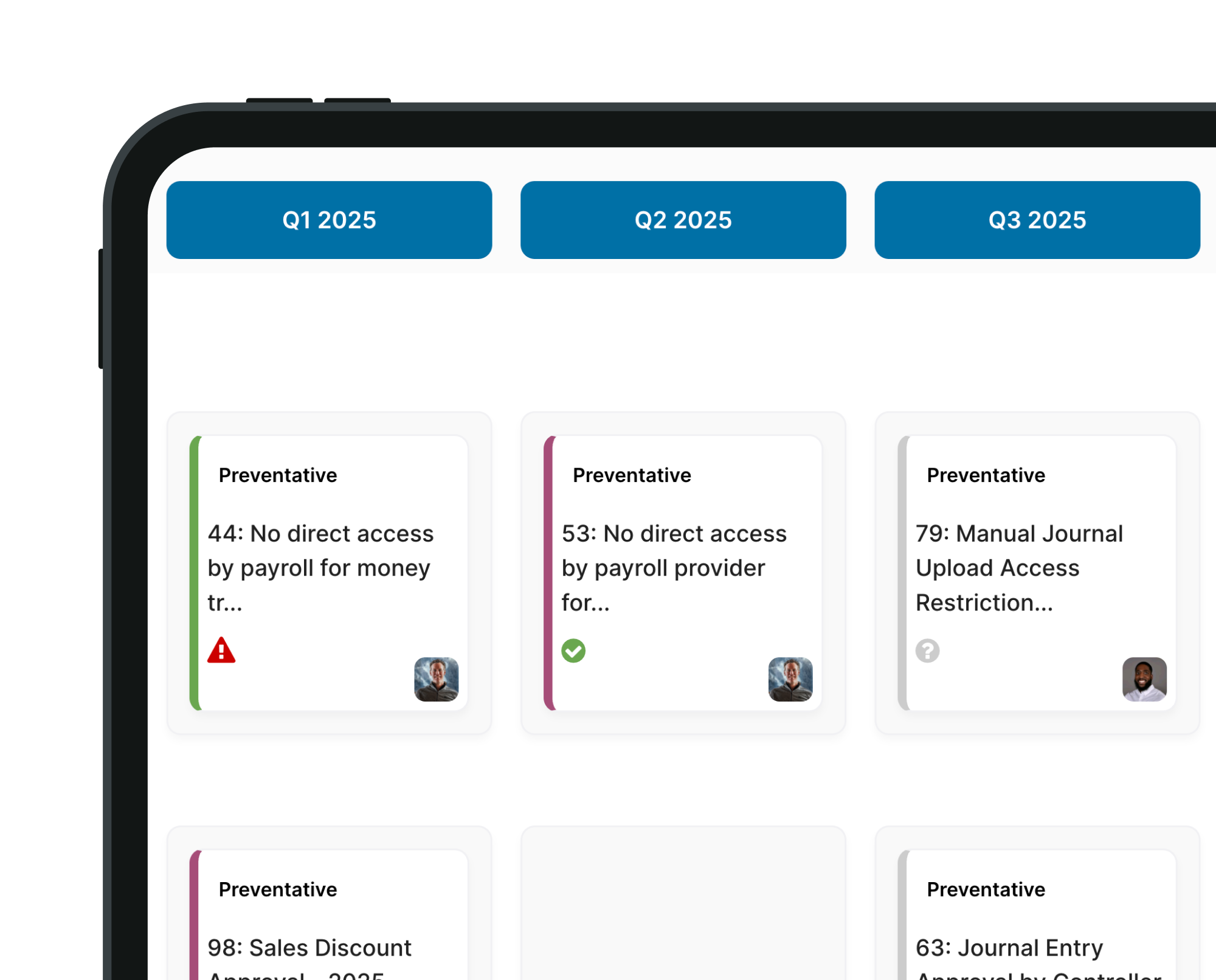

All-in-one SOX compliance

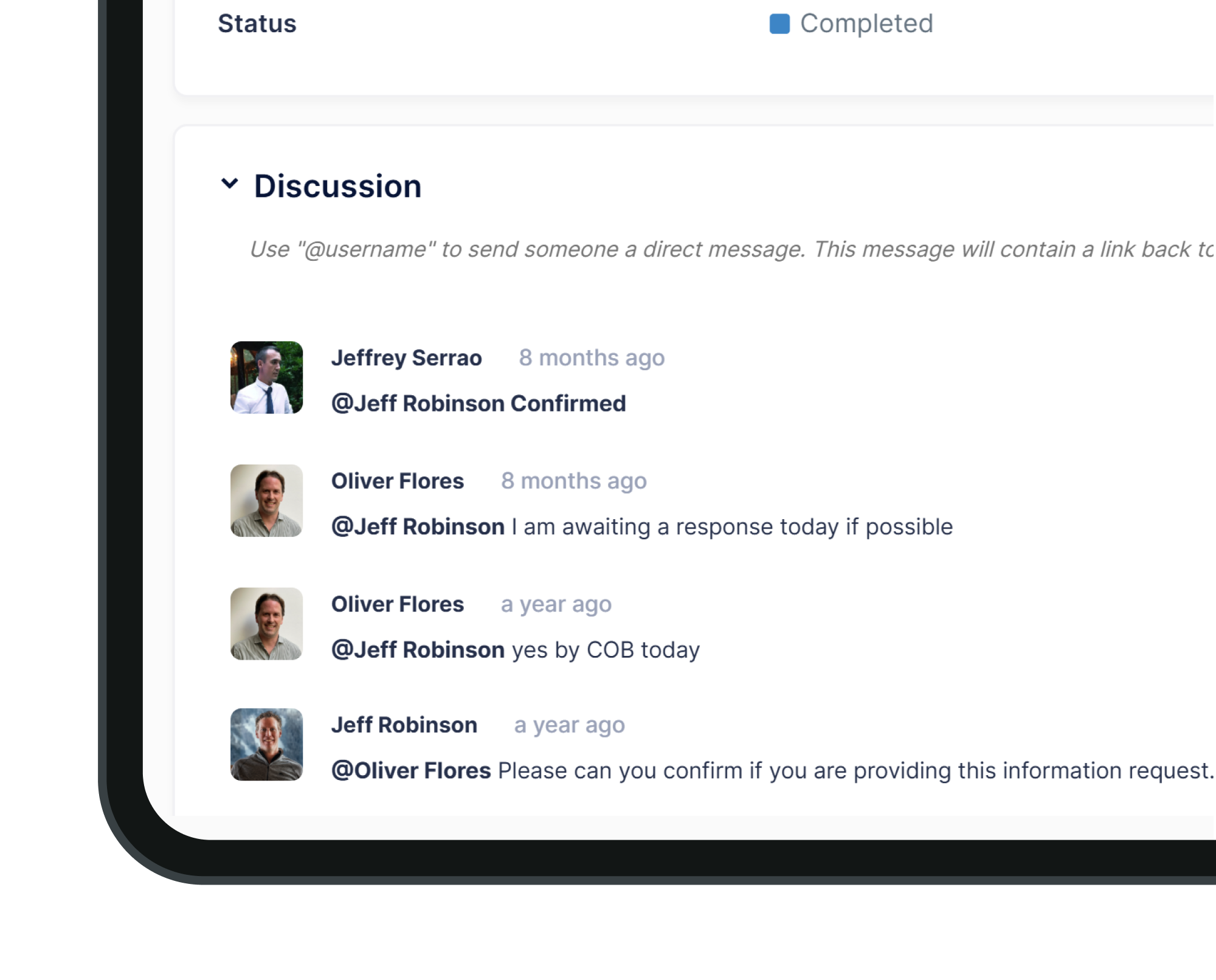

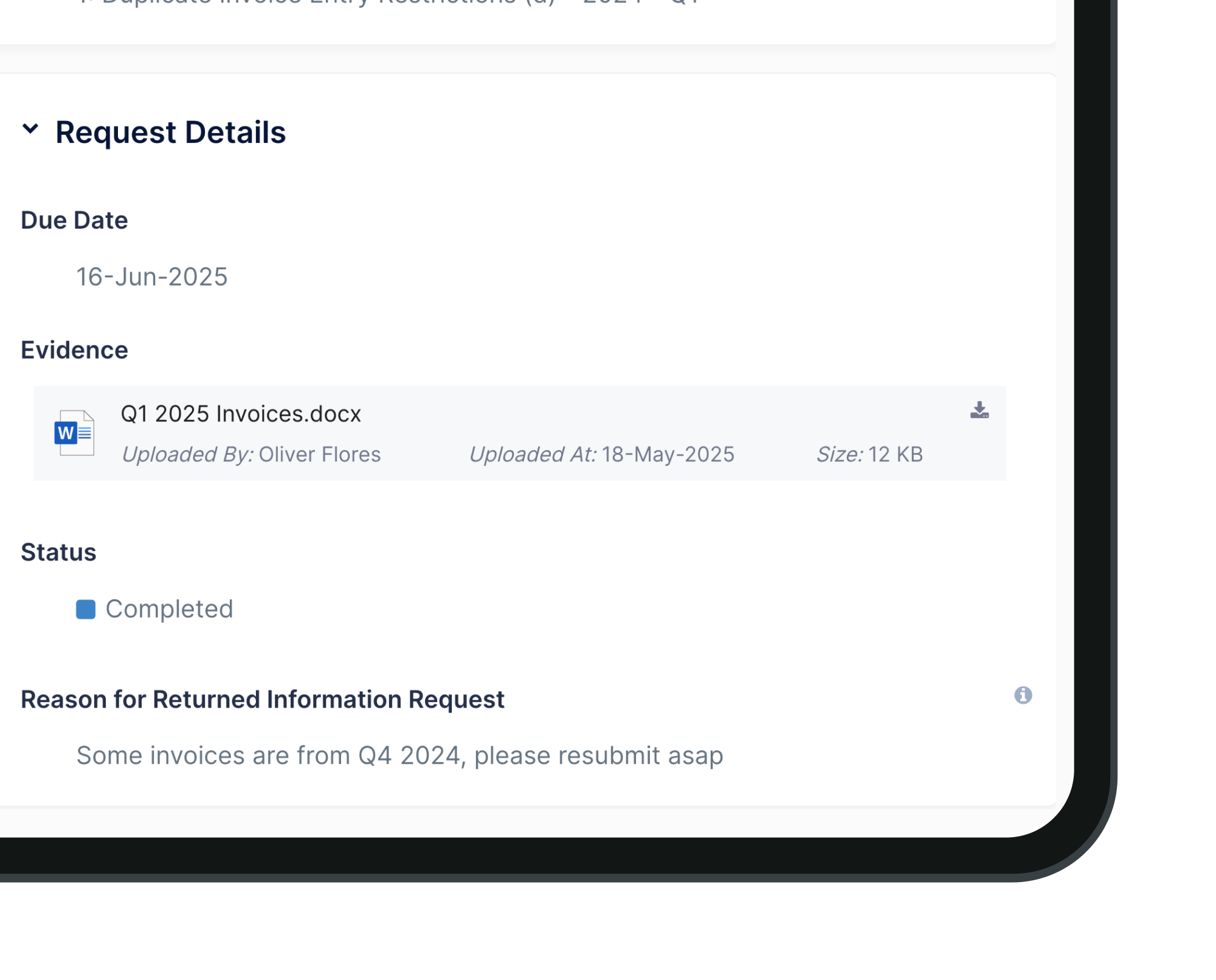

Capture planning, controls testing and remediation plans in one no-code repository, seamlessly connected with risk and control data from your organisation.

Trusted to deliver by industry leaders

.jpg)

A custom solution, ready in weeks

Fully integrated, built to scale with your business, and ready to use in weeks, not months.

Configurability, not complexity

Delivering business benefits

AI-powered compliance

A fully connected GRC platform brings data from across your extended enterprise into one place.

Benchmark performance

Share real-time performance outcomes with visualisations for compliance scores at every level of your governance framework.

Flexible pathways

Flexible compliance pathways link to any level of your compliance framework including board policies, business standards and controls.

Future-proof compliance

Stay one step ahead using AI scans for upcoming regulations so you can balance today’s compliance needs against what’s coming next.

Central change management

Seamlessly integrate regulatory and compliance change management into a single, central hub.

Agile, flexible, scalable

Eliminate lengthy change requests and take control without requiring dedicated IT resources.

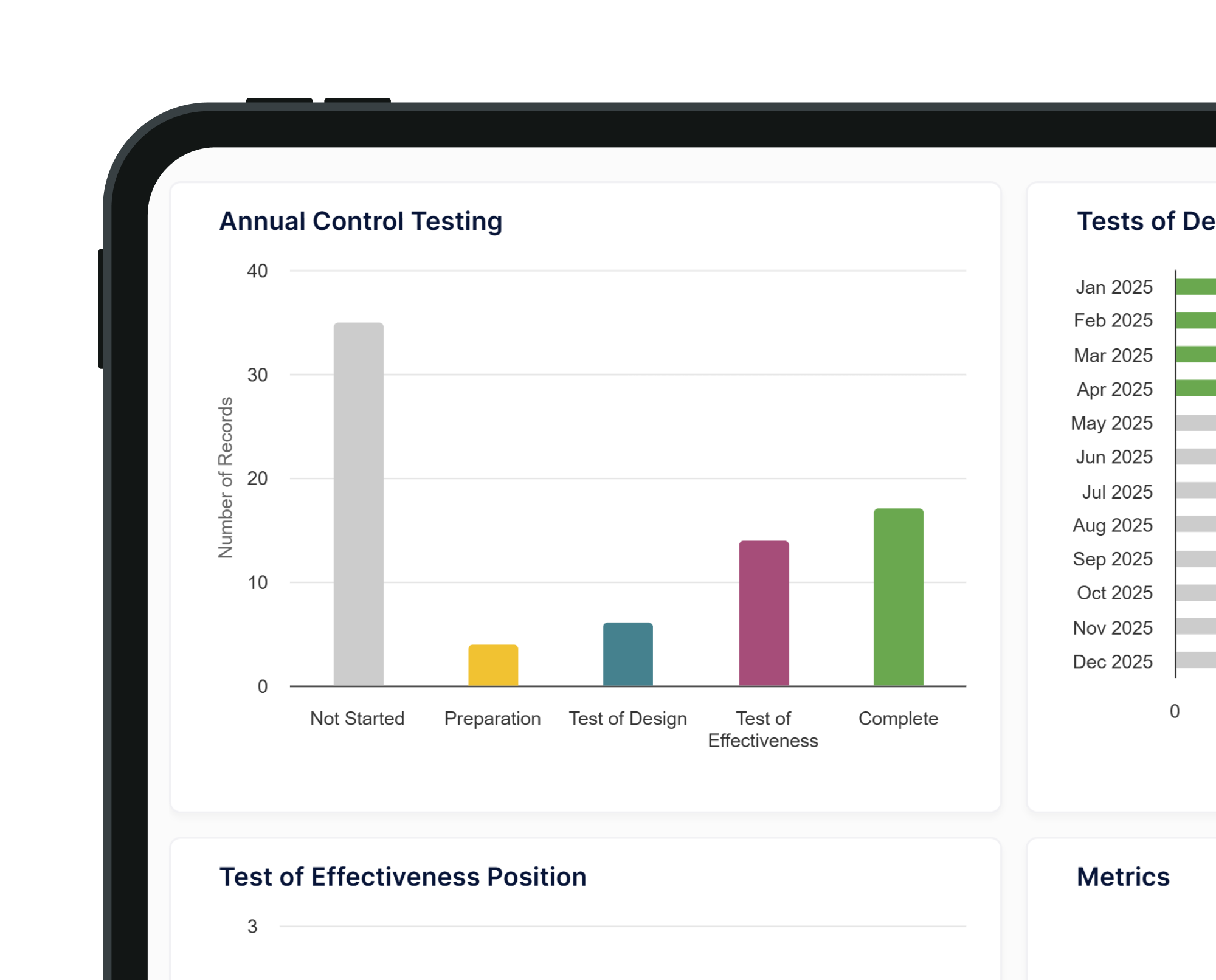

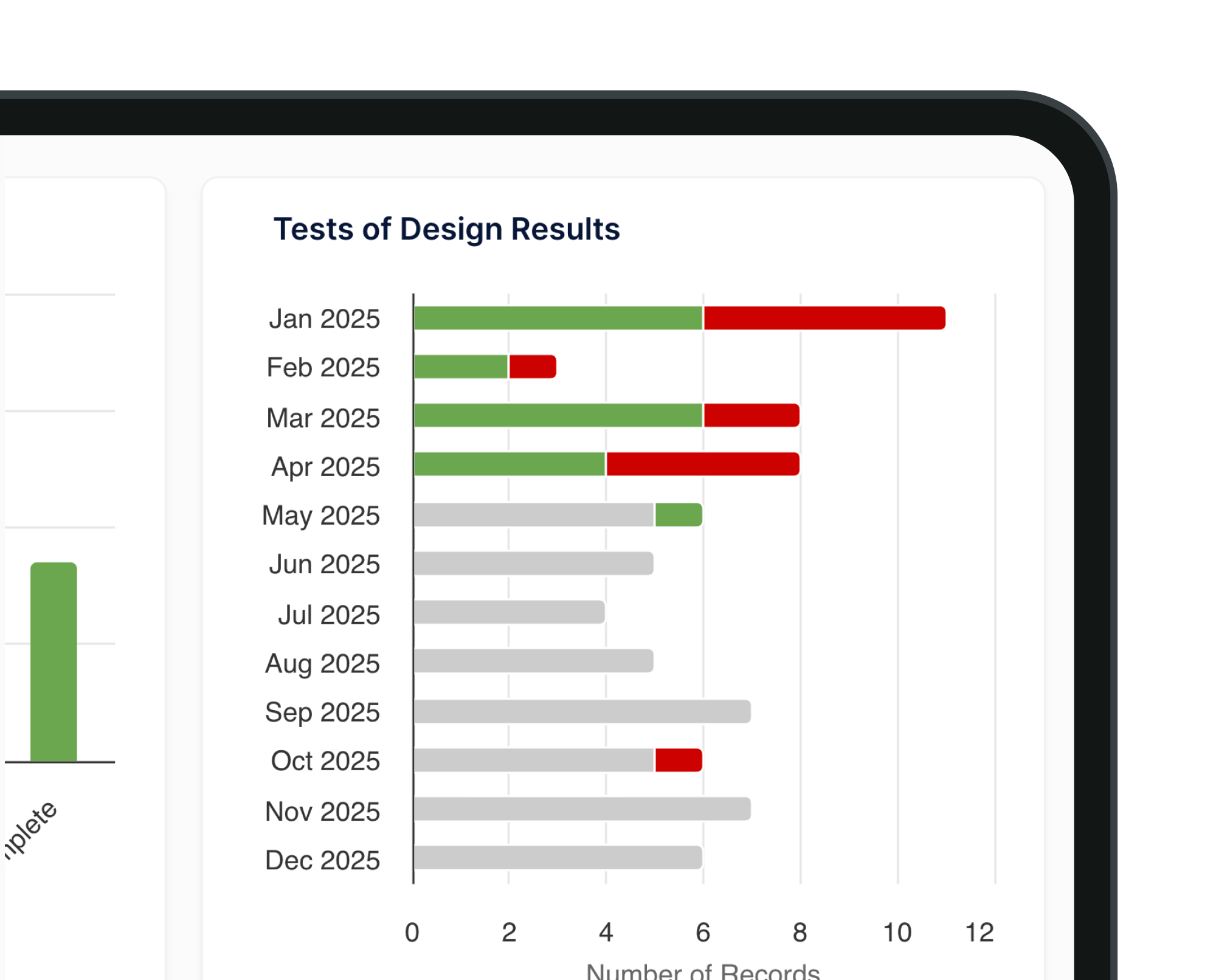

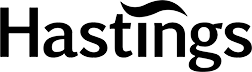

SOX Reporting

Visualise data & generate reports

Inform SOX decision-making with intuitive dashboards and powerful reports at the push of a button.

Report on anything you need

Leverage standardised and customised reports, including S302 certifications and Audit Committee papers.

Flexible matrix generators

Generate risk and control matrices with the flexibility to select only the data you want to see.

Featured Brochure

Sarbanes-Oxley Act (SOX) solution brochure

Our award-winning solution provides all SOX planning, testing, deficiency management and reporting in one no-code platform with role-specific access.

Related products

Enterprise Compliance Engine

Real-time compliance and regulatory change management, powered by AI.

Internal Audit

Plan, execute and manage your entire audit ecosystem in one place and automate reporting for efficient audit management.

Enterprise Risk

Identify and manage risk across your entire enterprise with a dynamic risk engine that keeps you ahead of emerging threats.

SOX

compliance software FAQ

Frequently asked questions

What is the Sarbanes-Oxley Act?

The Sarbanes-Oxley Act of 2002, often referred to as SOX, is a United States federal law enacted to improve the transparency, accuracy, and accountability of financial reporting by public companies to protect investors and maintain the integrity of the securities markets. SOX mandates strict requirements on corporate governance, financial disclosures, internal controls, and the independence of auditors to prevent corporate fraud and enhance investor confidence in the wake of accounting scandals such as Enron and WorldCom.

What is Sarbanes-Oxley Compliance Software?

SOX Compliance Software is a specialised tool or platform designed to help organisations ensure adherence to SOX compliance requirements. This software facilitates the implementation, monitoring, and enforcement of internal controls, financial reporting processes, risk assessments, and compliance activities mandated by SOX. SOX Compliance Software streamlines compliance efforts, automates control testing and documentation, and provides transparency and accountability in demonstrating compliance with SOX requirements.

What are the 4 SOX controls?

SOX outlines several key requirements, often categorised into five main sections. The four primary internal control provisions or controls prescribed by SOX are:

- Control Environment: Establishing and maintaining an effective control environment with a commitment to integrity, ethical values, and compliance.

- Risk Assessment: Conducting ongoing risk assessments to identify and assess financial risks that may impact the accuracy and reliability of financial reporting.

- Control Activities: Implementing specific control activities, policies, and procedures to mitigate risks, ensure financial accuracy, and safeguard assets.

- Monitoring Activities: Establishing monitoring mechanisms to track the effectiveness of internal controls, identify deficiencies, and take corrective actions when needed.

Is SOX compliance different in different countries?

While SOX is a U.S. federal law applicable to U.S.-based public companies and organisations with securities listed on U.S. stock exchanges, its principles and objectives have influenced corporate governance and regulatory practices globally. Different countries may have their own regulations and compliance requirements similar to SOX, but the specifics can vary based on local laws, regulatory frameworks, and cultural contexts. Organisations operating internationally may need to comply with both U.S. SOX requirements and local regulations, adapting their compliance programs to meet the specific regulatory expectations in each jurisdiction.

Any questions?

Or just curious to see a demo

The Decision Focus team are here to answer your questions.